Introduction

Insurance firms outside of Medicare offer a supplemental health care program for Medicare beneficiaries known as Medigap Plan F. It fills in the "gaps" left by Original Medicare by paying for copays, deductibles, and coinsurance. If you did not become eligible for Medicare by December 31, 2019, you could not purchase Plan F, even though it provides the most comprehensive coverage of any Medigap policy. Although it may be available to those who meet the requirements, it is often far more expensive than the Medigap policies that serve as its main competitors. Plan F is the most comprehensive Medigap plan available to those eligible, but alternative methods offer similar protections if you cannot.

How It Works

What is a Medigap Plan F? Medicare will fund a percentage of the allowed amount for healthcare services and expenses. As a result, the Medigap coverage will cover the difference. (Medicare supplement insurance costs money each month.) Medigap policies are only available to those with Original Medicare; Medicare Advantage enrollees cannot purchase them. Unfortunately, here's the catch for the vast majority of new members.

A Medigap Plan F policy will no longer be available for sale as of January 1, 2020, to people who first become Medicare-eligible after that date. After that time, insurers can no longer offer insurance that covers the Medicare Part B deductible. If you had Plan F coverage as of December 31, 2019, you would be able to keep it. You can purchase a Plan F policy if you became Medicare-eligible before that date but have yet to enroll. The monthly rates for Plan F are much higher than the premiums for Medigap Plan G with the Part B deductible.

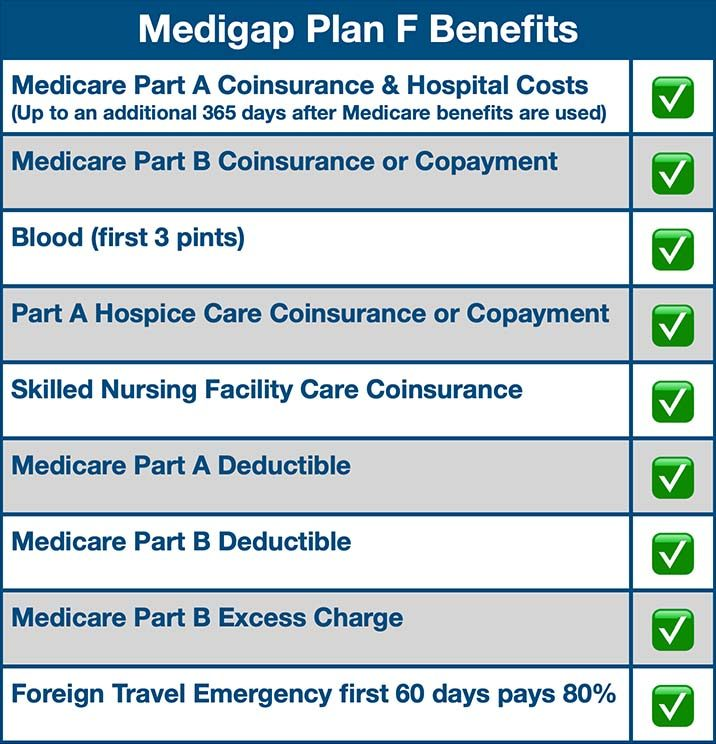

What Does Medigap Plan F Offer?

To better understand the Medigap coverage that will be discussed later, it will be helpful to examine three key concepts first.

Deductible

The deductible is the amount you're responsible for before Medicare begins to pay anything. Every year, your deductible starts over at zero.

Coinsurance

After the deductible is met, any remaining balance on your medical bill is known as "coinsurance." Percentages, like 20%, are commonly used to describe coinsurance. In such a scenario, Medicare would cover the cost of Medigap Plan F service at 80%, leaving you responsible for the remaining 20%.

Copayments

When you receive medical treatment, you may be required to pay a cost known as a copayment. For instance, visiting a doctor or pharmacy will require a copayment. Instead of being a percentage of the total bill, copayments are flat rates (usually $10 to $20).

Medigap Plan F Alternatives

If Medigap Plan F is what you're after but you don't qualify for it, Plan G is the next best thing. Due to regulations prohibiting the inclusion of the Medicare Part B deductible in plans marketed to new members, Medigap Plan G includes everything in Plan F except for that expense. All Medigap plans are comparable in terms of coverage, so you can pick the one that best suits your needs. All other states require their residents to enrol in a Medigap policy except for Massachusetts, Minnesota, and Wisconsin. Plans are regulated by the government but are sold by private insurers, who also determine premium costs. See Medicare.gov for price information on Medigap Plan G and other options.

By enrolling in a Medigap policy during your open enrollment period, you can save money and avoid any potential hiccups in the enrollment process. This time frame never repeats itself. The first six months of coverage begin when you turn 65 and sign up for Medicare Part B. (If you are still working after age 65 and have creditable coverage via a group employer plan, the six-month period begins when you stop working or lose coverage.) The best time to purchase a Medigap policy, and when you'll pay the least for it, is during the annual open enrollment period when insurance companies are prohibited by law from considering your age, gender, and health status when setting your premium.

Prices could go up, or coverage will be rejected once the trial period finishes. Suppose you have a disability and are under the age of 65 and qualify for Medicare. In that case, you can purchase a Medigap policy from an insurance company in some areas. SHIP, or the State Health Insurance Assistance Program, can provide further resources and details.

Conclusion

For those who are 65 or older and have enrolled in both Parts A and B of Medicare, the first six months after enrollment are the most advantageous for purchasing a Medigap policy. During the first six months of registration, a Medigap insurer cannot refuse coverage based on a preexisting condition or require a health screening. You can still apply for a plan after the first six months have passed. The company is not obligated to sell you Medigap coverage. Before reaching age 65, you may be ineligible to enroll in any Medigap plan. You should contact your local SHIBA office if you are 65 or older and have health insurance via your workplace.